Welcome to

The Resource Hub for

Black Women Entrepreneurs

Featured In:

Welcome to

The Resource Hub for

Black Women Entrepreneurs

Become a Member and Get a FREE Brand Planner!

Featured In:

Know Your Numbers. Know Your Plan.

At Sistahbiz Global Network, we are firm believers that knowing your numbers is the first step towards crafting a successful business plan. You can’t grow powerful business without a powerful plan. A powerful plan must have data. We specialize in empowering Black women in business through data-driven strategies and comprehensive business planning. Whether you join a self-paced workgroup or challenge, or come to a live lab or seminar, you’re going to get the tools you need to be a data-driven boss with a plan.

Success Stories

As you may remember, during our Book club at the top of the first quarter, I was manifesting location #2 forThe Drop Zone. Signed the lease, and received the keys today. You CANNOT know how impactful you are in the lives of the women you encounter.

KALISHA ABERCROMBIE TUCKER

KALISHA ABERCROMBIE TUCKER

The Drop Zone, NC

This year, MamaBird not only hit our financial goal, we crushed it. And baby when I say crush, I mean CRUSHED. Having the support of Sistahbiz helped me build a support system in my own organization that I absolutely love and trust.

BIRDIE EVANS JOHNSON

Mamabird Maternity Spa, CO

As I sit here, I just wanted to extend the most heartfelt thank you. I landed Homegoods in US, TJ Maxx/Winners/Homesense in Canada, and this April, Hustle & Hope cards will be in all World Market stores across the US. I remember when my "Market Traction" slide was looking a lil bleak...but wow, what 2 years has done! I could not have done it, in part without getting accepted into the Sistahbiz retail cohort.

ASHLEY SUTTON

Hustle & Hope, TX

With the loving guidance and support of SGN, I just cross walked my quarterly sales projections with current status. I’m half way to my quarterly target of with solid prospects to close out the quarter.

TAISHYA ADAMS

Mukuyu Collective

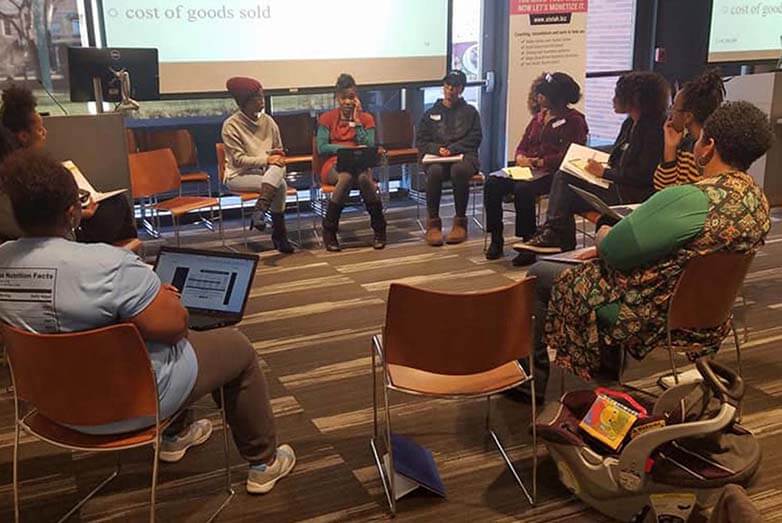

Workgroups and Coworking

Looking for some planning partners? We’re growing a community of serious Black women entrepreneurs who are committed to working on their businesses and we saved you a seat. From our business book studies to our business challenges and action planning workgroups, our community is about the work. This is the place to find your business bestie and the co-working tribe that will keep you accountable and walk alongside you.

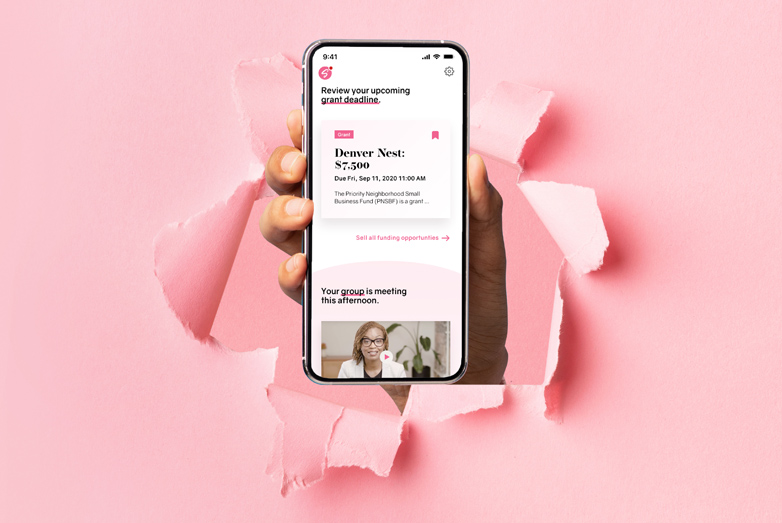

We’re all trying to make a dollar out of 15 cents. We understand the unique challenges faced by Black women entrepreneurs when seeking capital for their ventures. No more overwhelming searches, missed deadlines, or scattered notes. Access RFPs, grants, and pitch competitions all in one place, and sort them effortlessly by state or theme. Save and track your favorites, integrate deadlines with your calendar, and receive timely reminders.

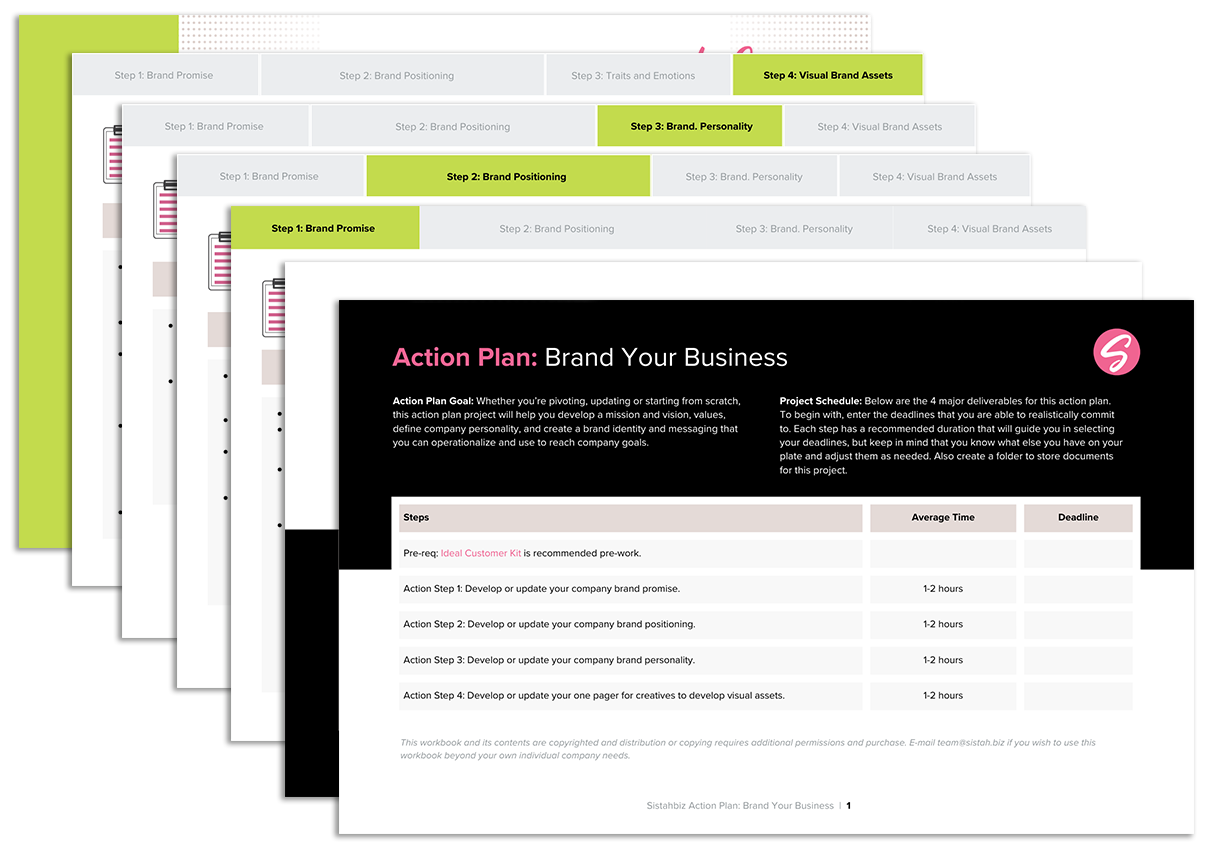

From budget and legal templates to business plans, sales funnel planners and email copy, members have access to dozens of ready-to-use templates from our business library. We send out all of the tools and materials needed to plan and build in community each month.

We’ve heard time and again about the transformative power of personalized coaching at Sistahbiz. Schedule your complimentary coaching session today and discover how our team of experienced Black women coaches can assist you in achieving your business goals.

Try the Suite for 14 days and access:

- Coworking w/ Materials

- Group Coaching

- Business Directory

- Templates Library

- Training Events

Latest from our Blog

How Sistahbiz Workgroups Empower Black Women Entrepreneurs

Mastering the Ropes of Entrepreneurship: Lessons from Double Dutch

Kisha’s Favorites: The 2023 Sistahbiz Holiday Gift Guide

Meet Makisha Boothe

Makisha has been honored by the Colorado Women’s Chamber of Commerce as one of the Top 25 Women in Business in 2021, the 2009 Colorado Black Chamber of Commerce with the Clara Brown Award, and by the Aurora Chamber of Commerce with the Women in Business Unsung Hero. She is a recipient of the 2007 U.S. Small Business Administration Young Entrepreneur of the Year and the 2022 RVC Business Catapult award by the Rockies Venture Club. Makisha has been featured in Forbes, Ebony, NPR, Black Enterprise, the Denver Business Journal and other notable media outlets. Called “Coach K” by the Sistahbiz village, she was named one of Conscious Company’s 43 world-changing women, and one of the top 20 coaches to follow by Talent LMS.

Contact Us

Please provide some details about you and we will be sure to get back to you.

Finally, Affordable Sales Techniques!

Download your free guide to affordable and practical ways to bring in more customers.

Sistahbiz Global Network © 2024 | Privacy Policy | Denver, CO 80249 |

Contact us at [email protected].